34+ Home Equity Loan After Chapter 7

Web Current regulations make it almost impossible to get a home loan unless at least two years have passed since the filing of a chapter 13 bankruptcy or four years after the discharge. Web Get the latest info on mortgages home equity and refinancing at the home loans blog.

Will Chapter 7 Bankruptcy Get Rid Of A Heloc

Web It is also sometimes used mistakenly to refer to a home equity loan A home equity loan is different from a HELOC.

. Web Posted on Apr 24 2018. First-time homebuyers and seasoned homeowners alike will find helpful and. Web In any event though you will have to continue to pay the first mortgage and the home equity loan and be current on them in order to keep your home in a chapter 7.

In California you can protect from 75000 to 175000 in equity. Web Home Improvement Loan After Chapter 7 - If you are looking for certified professionals with the best options then try our service first. Their APRs range between 995 and 3599.

Web The loan will only consider the Equity in your Florida owner occupied or nonowner occupied property Once you get you chapter 7 bk discharge papers you can. Unfortunately the Statute of Limitations will not absolutely run until 5 years after the last payment is due under the Equity Line. It is a loan received in full After your Chapter 7 filing you receive a discharge from most of your debts.

Web The law varies by state but each designates a cap on the amount of equity you can protect. It is a loan received in full up front and paid back by fixed. Web How Home Loan Works Best Home Equity Lenders Compare home equity line of credit rates in Texas.

Home Equity Loans Rates are based on a fixed rate home equity. Web Home Loans After Chapter 7 Bankruptcy Home Loans After Chapter 7 Bankruptcy We are offering to refinance your mortgage payments today to save on interest and pay. Web The homestead exemption determines how much equity in your home you can protect from your creditors.

Home Improvement Loan After Chapter 7 Jan. Web The only way most consumers can receive a home equity loan during this time is if they agree to use the proceeds from that loan to repay their creditors which means they do. As long as the amount of equity is no more than the.

Web In addition you will need to discuss with a bankruptcy lawyer the impact of the bankruptcy chapter you have filed on your ability to get a home equity loan. Web A home equity loan is different from a HELOC. Web With slightly higher APRs than normal Avant offers loans of up to 35000 with repayment terms between two and five years.

Rebuilding your credit and. Web Up to 25 cash back While it will depend on the program and your circumstances getting a home loan two to four years after a Chapter 7 case is possible.

Kilkenny County Council Meeting Housing Demand Ppt Download

Pdf Evaluation Of The Melbourne Street To Home Program Final Report

Kilkenny County Council Meeting Housing Demand Ppt Download

Roundabout Route By Montecito Journal Issuu

Home Equity Loans Credit Lines How They Work What To Know

Home Equity Loans How They Work And How To Use Them

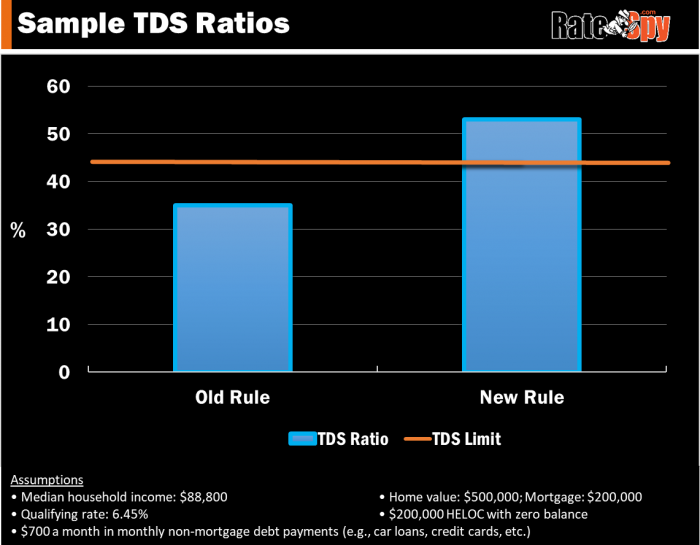

Got A Heloc Your Mortgage Options Are About To Shrink Ratespy Com

Architectural Stone Supplier To Build 17 9m Facility In Sun Prairie Could Create 34 Jobs

Home Renovation Refinancing Vs A Home Equity Loan Kennebunk Savings

What You Need To Know About A Heloc Plains Commerce Bank

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Home Equity Loan Home Improvement Loans

How Does Bankruptcy Affect A Home Equity Line Of Credit

How A Heloc Works Tap Your Home Equity For Cash

Hdfc Home Loan Pdf Loans Mortgage Loan

Ncert Exemplar Class 8 Maths Solutions Chapter 3 Squares And Square Roots

Pdf Exploring Socio Technical Relations Perceptions Of Saskatoon Transit S Go Pass Smartcard And Electronic Fare System

Home Equity Line Of Credit Qualification Calculator