Formula to back out sales tax

In this condition you can easily calculate the sales tax by multiplying the price and tax rate. To calculate the after-tax income simply subtract total taxes from the gross income.

How To Calculate Find The Sales Tax Rate Or Percentage Formula For Calculating Sales Tax Rate Youtube

How to Calculate Sales Tax Backwards From Total Subtract the Tax Paid From the Total.

. Subtract that from the receipts to get your. Calculator formula Here is how the total is calculated before sales tax. If the sales tax is included in your gross receipts it should be backed out.

Apr 07 2022 The formula for after-tax income is quite simple as given below. To calculate the sales tax backward from the total divide the total amount you received for the. Select the cell you will place the calculated result enter the formula B1B2 B1 is the price exclusive.

Calculate the canada reverse sales taxes HST GST and PST Do you like Calcul Conversion. To back this out take your total amount of gross receipts including the sales tax divide by 100 plus. Divide the Tax Paid by the Pre-Tax Price.

Let S the true sales of products excluding the sales tax and let 007S the sales tax on the true sales. Multiply by the sale price. OP with sales tax OP tax rate in decimal.

Backing sales tax out of a total including sales tax Totals in A1 A110775 or more generic if there are other sales tax rates involved with the sales tax percentage in B1 A1. Divide the Tax Paid by the Pre-Tax Price. Instead of using the reverse sales tax calculator you can compute this manually.

How to Calculate Sales Tax Backwards From Total Subtract the Tax Paid From the Total. Divide your sales receipts by 1 plus the sales tax percentage. The formula to back out sales tax from a purchase is written as total price 1 sales tax rate cost without sales tax according to the financial section of the Houston.

Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if the. Add the sales tax to the sale price. To find the original price of an item you need this formula.

Convert the Tax Rate to a Percentage. Add up all the sales. After this initial setup youll be able to manually back out the estimated amount of tax collected from reporting.

For example if the sales. Amount with taxes Canada Province HSTQSTPST variable rates Amount. Convert the Tax Rate to a Percentage.

Multiply the result by the tax rate and you get the total sales-tax dollars. Divide the Post-Tax Price by the Decimal. There are three steps you can follow to use the sales tax formula.

To calculate the sales tax backward from the total divide the total amount you received for the items subject to sales tax by 1 the sales tax rate. How do you back out tax on a calculator. Reverse Sales Tax Formula.

The formula to back out sales tax from a purchase is written as total price 1 sales tax rate cost without sales tax according to the financial section of the Houston. Add up all sales taxes. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without.

Update the sales price and taxable status of items using Bulk Management or. Since the true sales the sales tax 48150 we can state this as S 007S.

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

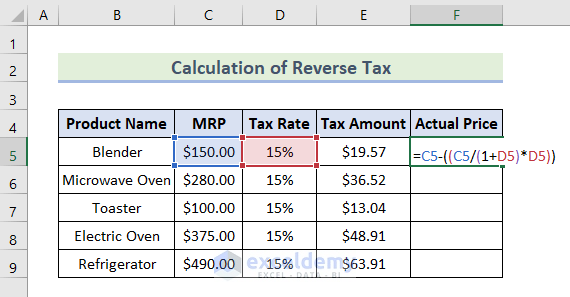

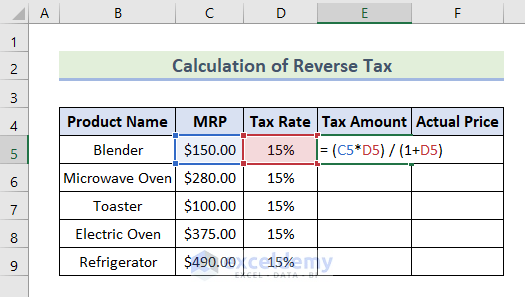

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Z0ulw0dqilamjm

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator

Profit Before Tax Formula Examples How To Calculate Pbt

Sales Tax Calculator

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Find The Sales Tax Rate Or Percentage Formula For Calculating Sales Tax Rate Youtube

How To Calculate Sales Tax In Excel

6 Differences Between Vat And Us Sales Tax

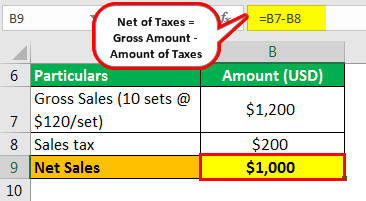

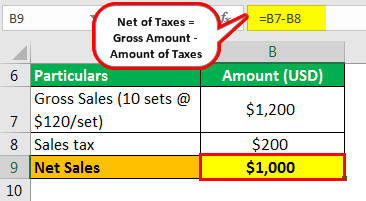

Net Of Taxes Meaning Formula Calculation With Example